- Call :09335144442

- email us at:cruxacademy@gmail.com

An ISO 9001:2015 Certified Institute

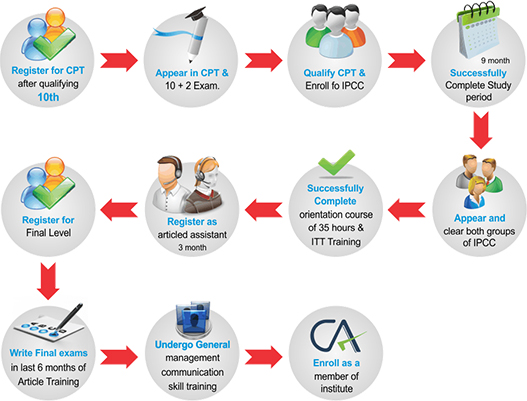

CA Road MAP

CA Courses

-

2nd LEVEL: Integrated Professional Competency Course (IPCC)

Articleship (Practical Training) - After clearing

Group -I or Both Group of IPCC

100 Hours of Information Technology Training (ITT)

Orientation Programme (35 Hours)The Chartered Accountants Professional Competence Examination is held twice every year in the months of May/June and November/December. It comprises of two groups. Candidate can appear, at one sitting, for both groups / group - I / group - II as the case may be subject to fulfillment of eligibility condition.

Subjects

GROUP - I

Paper - 1

Accounting (100 Marks)

Paper - 2

Law, Ethics and Communication (100 Marks)

- Business Law (30 Marks) - Company Law (30 Marks) - Business Ethics (20 Marks) - Business Communication (20 Marks)

Paper - 3

Cost Accounting and Financial Management

- Cost Accounting (60 marks) - Financial Management (40 Marks)

Paper - 4

Taxation - Income Tax(50 marks) - Service Tax (25 marks) - VAT (25 Marks)GROUP - II

Paper - 5

Advanced Accounting (100 Marks)

Paper - 6

Auditing and Assurance (100 Marks)

Paper - 7

Information Technology (50 Marks) and Strategic Management (50 Marks)

- Information Technology (50 Marks)

- Strategic Management (50 Marks)[For further details, reference may be made to the study material of the Institute and the Chartered Accountants Regulations, 1988].

-

3rd LEVEL: C.A. Final course

GMCS (General Management and communication skills) TrainingThe Chartered Accountants Professional Competence Examination is held twice every year in the months of May/June and November/December. It comprises of two groups. Candidate can appear, at one sitting, for both groups / group - I / group - II as the case may be subject to fulfillment of eligibility condition. Each group comprises of four papers as detailed below:

Details of Old Course Subjects

Group I Paper - 1 Advanced Accounting Paper - 2 Management Accounting & Financial Analysis Paper - 3 Advanced Auditing Paper - 4 Corporate Laws and Secretarial Practice

Group II Paper - 5 Cost Management Paper - 6 Management Information and Control Systems Paper - 7 Direct Taxes Paper - 8 Indirect Taxes

(For further details, reference may be made to the study material of the Institute and the Chartered Accountants Regulations, 1988)

Details of New Course Subject

Group I Paper 1: Financial Reporting (100 Marks) Paper 2: Strategic Financial Management (100 Marks) Paper 3: Advanced Auditing and Professional Ethics (100 Marks) Paper 4: Corporate and Allied Laws (100 Marks) Section A: Company Law (70 Marks) Section B: Allied Laws (30 Marks)

Group II Paper 5: Advanced Management Accounting (100 Marks) Paper 6: Information Systems Control and Audit (100 Marks) Paper 7: Direct Tax Laws (100 Marks) Paper 8: Indirect Tax Laws (100 Marks) Section A: Central Excise (40 Marks) Section B: Service Tax & VAT (40 Marks) Section C: Customs (20 Marks)

Highlights of the new final course:

Financial Reporting: This new subject deals with the whole gamut of financial reporting specially corporate financial reporting. This subject also focuses on learning of IFRS based financial reporting and US GAAP based financial reporting. This is aimed at making Indian chartered accountants globally competitive. Business valuation principles are also covered in this new subject.Strategic Financial Management:

consultancy has become a key functional area of the chartered accountants. With a view to strengthen this knowledge area, this paper has been introduced. Special focus of this paper are on Mergers and Acquisitions, Investment Analysis and Portfolio Management, Financial Derivatives, Commodity Derivatives, Global Sourcing of Capital ADR, GDR and Foreign Exchange Risk Management.Advanced Management Accounting:

This course has been conceptualized to strengthen the strategic role of a chartered accountant in an organization as a management consultant. Special focus of this paper is on Strategic Cost Management including Activity Based Cost Management, Target Costing, Value Chain Analysis and Restructuring the Value Chain, Transfer Pricing including International Transfer Pricing within the WTO framework, Financial Modelling using Quantitative Techniques and Cost Management in Service Sector.Advanced Auditing and Professional Ethics:

The updated version of this course focuses on application of Audit and Assurance Standards in practical situation and knowledge of Professional Ethics. Information Systems Control and Audit: This course is formulated with a view to enhance the knowledge of the Chartered Accountants on relevant aspects of Information Technology and their applications in accounting, audit and finance. The special focus of this course is on Information System Control Techniques, Data integrity privacy and security, Risk Assessment Methodologies, Information System Auditing Standards, Guidelines & Best Practices, and Information Security Policy.In addition, principle of e-governance has been emphasized in Corporate and Allied Laws, International Taxation and Value Added Tax are important features of the updated subject contents of Direct Tax Laws and Indirect Tax Laws respectively.

-

Preparation for CA foundation

Dear CA Aspirants...

Amongst all the crisis we’ve got your life sorted with a comprehensive detail of time management & revision mapping analysis for CA-FOUNDATION aspirants.

PLEASE GO THROUGH IT CAREFULLYPULL UP YOUR SOCKS & KICKSTART YOUR PREPARATIONS TODAY...If you have any further queries please message us on our Facebook pages.Also follow us at instagram @cruxkanpur.